How Can Auto Loan Refinancing Affect Your Finances?

When you refinance a car, you replace your current car loan with a new loan of different terms. In practice, auto refinancing is the process of paying off your current car loan with a new one, usually from a new lender. This process can have varying outcomes for car owners.

Most people refinance their car in order to save money, but this goal can take multiple forms. For example, some refinance to lower their monthly car payments, others want to reduce their interest rates or adjust the length of their loan term. And still others have more personal reasons to refinance, such as removing co-signers from their loan. No matter what your goal is for refinancing your car, it’s important you understand the possible outcomes. If you want to know when it may make sense to consider refinancing your car, this article may help: When can I refinance my car loan?

Possible Outcomes When Refinancing Your Car

Not all car loan refinance deals are the same, but customers who choose to refinance often seek one of the following goals (this list is not exhaustive):

Lower Your Monthly Car Payments

Most of the time, people seek car loan refinancing to lower their monthly payments. This priority is understandable since monthly car loan payments can have an immediate impact on a household’s monthly finances. However, your monthly payment should not be the only consideration when refinancing…

There are two ways to lower your car loan monthly payments—you can get a lower interest rate, you can extend your loan term, or both. Usually, the best way to lower your car loan payments dramatically is to extend the number of months over which you pay for your car. However, when you extend your loan term, you may end up paying more for your car in total than you would without extending it. Still, if your lender allows you to extend your loan term and gives you a lower interest rate, you may benefit by both lowering your monthly payments and paying less in total for your car. The example below will illustrate how this outcome can occur.

Decrease Your Interest Rate and/or Reduce Your Interest Charges

While it is interrelated with the goal of lowering monthly payments, some refinance customers prioritize lowering the interest rates on their loans. If during the course of paying off your car loan, you improve your credit worthiness in the eyes of lenders (they sometimes evaluate you according to the Four C’s of Credit), then you can usually get a new loan with a lower interest rate. When you lower your interest rate it may reduce the total in interest charges you pay on your car loan—assuming your car loan term is not extended or not extended by too many months.

Change the Length of Your Car Loan Terms

Sometimes refinance customers seek refinancing to change the length of their loan terms. However, this goal usually has more to do with lowering monthly payments than changing how many months in which a customer pays for his/her car.

Remove or Add Someone as a Co-Signer to Your Loan

For various personal reasons, sometimes car loan borrowers want to refinance in order to remove or add someone to their car loan. Refinancing is an easy way to do this, because the refinance process gives you a new loan with a new contract.

Want to Lower Your Car Payment?

Example: Refinancing a Car Loan

As an example, let’s say that one year ago you purchased a car for $20,000. A lender loaned you this amount at 6% interest (APR) to be paid back over 48 months. Now, 12 months later, you decide to refinance because you would like to reduce your monthly payments. So, you connect with a new lender that will pay off your old lender and give you a new loan. This new lender offers to give you this loan at a 3% interest rate (APR) with a loan term of 48 months. Effectively, by refinancing with this new loan term, you will be paying for this car for a total of 60 months (adding the new 48 month loan term to the one year (12 months) you were paying it off with the old lender).

So, what would the financial impact of a car refinancing have on how much you pay for your car? For the sake of simplicity in this example, let’s assume that you will not pay any fees to refinance and are not going to buy any service protection products with your new loan (note, refinancing almost always comes with fees and many refinancing customers opt to buy service protection products). After making the 12th payment on your old car loan, you still owe the original lender $15,440. Your new lender loans you this amount by paying your old lender the $15,440 you still owe. Now, your first payment on the new refinanced loan occurs in what would have been the 13th month of your old loan.

The monthly payments on your new loan would be $341.75 compared to the $469.70 per month you paid on the original loan, and, by the end of your loan, you would pay $22,040 with refinancing after the first 12 months [$22,040 = $469.70 *12 + $341.75 * 48].

Without refinancing after 12 months, you would pay $505 more for your loan, ultimately costing you $22,546 for your loan [$22,545 = $469.70 * 48]. If you would like to know more about how any of the numbers in this article are calculated, read this article on how car loan interest works.

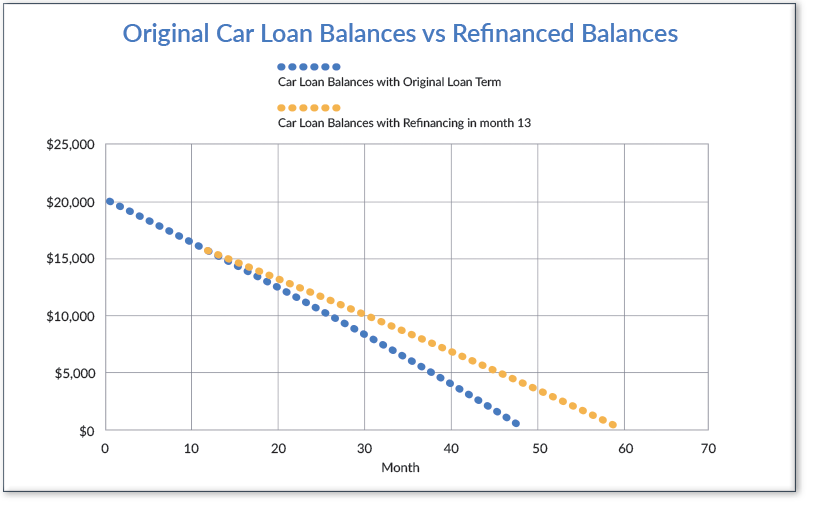

The graph below depicts how you would pay down your car loan(s) in this example with and without refinancing.

Notice how the car loan balance with refinancing line (in orange) falls at a slower pace over the loan term than the car loan line without refinancing (in blue). Because, in this example you extended your loan term, you pay less of your principal each month and have more time to accumulate interest charges. As a result, you pay off your loan at a slower pace than before refinancing. However, your new interest rate of 3% is sufficiently below your old interest rate and in the end you cumulatively pay less interest charges than if you had not refinanced.

Please note, you should always make your car loan payments as scheduled even if you are in the middle of the refinancing process. Moreover, just because in this example you make your last payment on your old loan in month 12 and make your first payment on your new loan the next month does not mean that the car loan refinancing process can always be completed in the time span between car loan payments.

While the example above illustrates how refinancing can benefit a borrower, you should note that refinancing can have various impacts on a person’s finances. When and if you choose to refinance, you may or may not change the length of your loan, and your interest rate does not necessarily have to change – although most of the time it will. Ultimately, every car refinancing deal is different and every refinance customer has personal motivations for refinancing. For this reason, you may benefit greatly when you work with an auto loan company that takes the time to learn about your needs and will match you with a car loan that meets those needs.