Learn How GAP Can Protect You

Guaranteed Asset Protection (also known as “GAP Protection,” “GAP Coverage”, or simply “GAP”), protects you from paying for a car that no longer exists because of an accident or theft.

How GAP Works

GAP guarantees that your car loan does not become a financial burden if your car is totaled in a car crash or is stolen.

GAP protects you during periods when you are “upside down” or “underwater” in your car loan, meaning you owe more on your car than it is worth. We’ll discuss specific reasons why this might happen to you below, but in general people become “upside down” in their car loans because of how car depreciation and car loan amortization interact. If your car’s value depreciates faster than you pay down your loan (i.e. amortization), then you will become upside down in your loan.

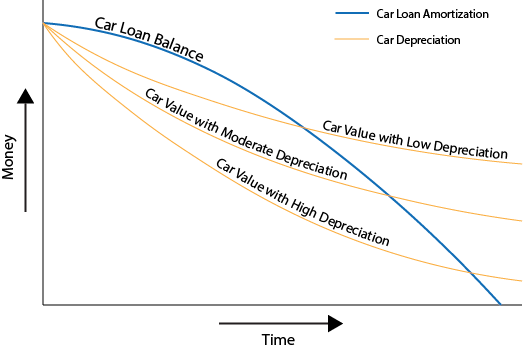

The graphic below illustrates how people’s car values and car loan balances usually interact.

Car Depreciation refers to how cars lose value. The basic concept is simple, but the way cars actually lose value is complicated. Most new cars lose value quickly early on in their driving lives but more slowly after their first few years on the road (as the blue line in the graphic above illustrates). Factors like car make, model, and condition as well as economic forces determine an individual car’s level of depreciation over the years. Companies like NADA Guides and Edmunds provide car depreciation estimation services, but you can never be sure of what your car’s exact value will be at any point in the future.

Car loan amortization, on the other hand, refers to the structured way that a car loan borrower pays down his/her car loan. Because of the way car loan interest works, you pay greater interest charges with your monthly car loan payments early on in your car loan than near its end. Consequently, you pay down your principal (i.e. the amount you borrow) at a relatively slow rate early on in your loan but at an increasing rate over time (as the orange lines depict in the above graphic). Assuming you stick to your car loan payment schedule, you can find out exactly what your loan balance will be at every point in your car loan. Just ask your lender for your amortization schedule or generate one yourself using an online car loan amortization table calculator.

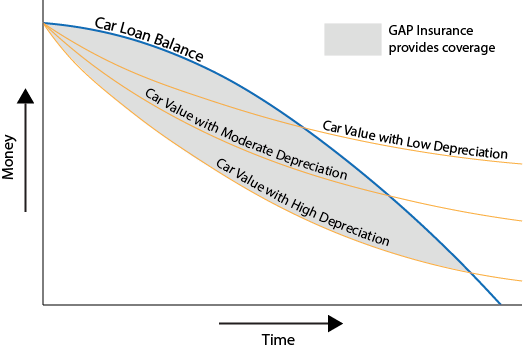

You are “upside down” in your car loan when your car loan balance exceeds your car’s market value. GAP protects you during these periods, which can last for years – sometimes almost the entire time you are making payments on your car. The graphic below shows when GAP protects you.

Loan Characteristics that Increase Your Risk of Being “Upside Down” in Your Car Loan

Anyone with a car loan can become “upside down,” usually through no fault of their own. Still, a borrower can structure his/her loan in such a way that they are more likely to become “upside down” or to stay “upside down” for longer periods of time. The following are ways borrowers sometimes exacerbate the depreciation-amortization interaction such that they are more likely to be “upside down” in their loans (this list is not exhaustive).

- Borrowing too much. Most borrowers take on car loans that are greater than their cars’ values to cover taxes, service protection products, fees, and other expenses. The more you borrow, the higher your Loan-to-Value ratio (or LTV) will be, which describes how much you borrow relative to how much your car is worth. And the higher your LTV, the more likely you will become “upside down” in your car loan and stay “upside down” for longer.

- Declining to make a down payment. Your lender may not require you to make a down payment on your car before giving you a car loan. However, you can always make a down payment on your car when you buy or refinance, and you should consider doing so. When you do not make a down payment, you have to borrow more to cover your car purchase, making it more likely that you will owe more on your car than it is worth at some point.

- Buying a car that depreciates quickly. Some cars depreciate faster than others. Sometimes analysts predict quite accurately how a given car will depreciate, but sometimes the market is surprised by how a car of a certain make, model, and model year loses value over time. Make sure you research the expected depreciation of any car you consider buying, knowing that you want a car that holds its value well. Not only will a car with low depreciation reduce your risk of becoming “upside down” in your loan, but it will increase the likelihood that you can resell your car for a good price.

- Having a longer loan term. Simply put, the longer your car loan term length, the longer it will take to pay down your car loan. And the slower you pay down your car loan, the more likely that your car’s value will fall below the amount you owe on your car loan.

Please note, nothing is wrong with making a decision that leads to one of the four situations listed here. Every car loan is different so what matters is that you evaluate your own financial situation when making borrowing decisions.

Is GAP Worth It?

GAP is a smart buy for many car owners. Most cars lose significant value during their first few years on the road, oftentimes around 20% in the first year and over 50% by the end of the third year (car depreciation rates vary widely, but websites like NADAguides.com and Edmunds.com can provide you much more information on car depreciation). So, if you take on a car loan to buy or refinance your car, chances are you will be “upside down” in your car loan for a time, especially if you do not make a significant down payment on your car or pay back your loan in two or three years.

GAP will protect you during periods of owing more on your car loan than your car is worth, which can last almost your entire car loan. One of the last things any car owner wants is to pay for a car that no longer exists.

Avoiding Negative Equity

Another way to look at GAP is that it protects you from “negative equity.” Negative equity is debt from one car loan that you roll into another car loan.

Oftentimes, people without GAP whose cars are totaled in an accident and who are “upside down” in their car loans decide to roll their remaining car loan debt into their next loans, increasing their next car loans’ payments and making it more likely that they will be “upside down” with their new car loans.

You want to avoid negative equity because it is something that can build from car loan to car loan. And while GAP will not help you if you sell your car for less than you owe on your car loan, it will protect you from having to pay for a car loan after your vehicle is totaled in an accident or is stolen.

One of the worst outcomes for a car owner who has invested in a car is to have his or her car totaled in a crash or stolen. GAP ensures that such an outcome will not happen to you.